About

Charles Schwab is a leading provider of full-service wealth management solutions, offering a wide range of accounts, investment products, and advisory services. With a commitment to putting clients first, Schwab aims to empower investors and help them achieve their financial goals.

One of Schwab’s key strengths is its transparent pricing and low costs. Unlike some competitors, Schwab provides clear information about fees, enabling clients to make informed decisions about their investments. This approach aligns with Schwab’s philosophy of ensuring that investors get the best possible value.

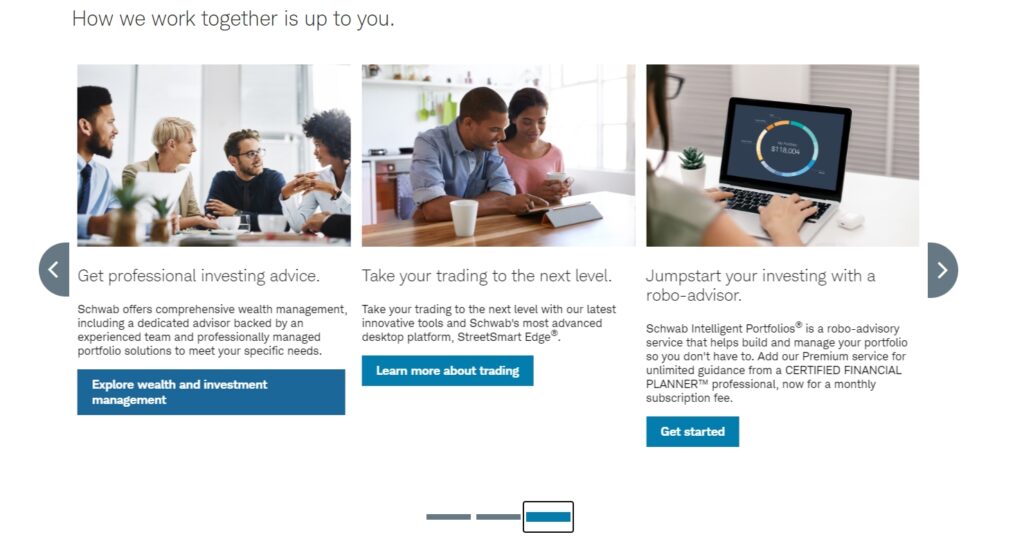

Schwab offers various types of accounts and investment products to cater to individual needs and preferences. Whether clients are interested in brokerage accounts, 401(k) rollovers, individual retirement accounts (IRAs), or small business retirement plans, Schwab has them covered. The platform also provides access to a diverse range of investment products, including stocks, mutual funds, exchange-traded funds (ETFs), annuities, and bonds.

What sets Schwab apart is the flexibility it offers to clients in choosing how they work with the platform. Clients have the freedom to decide what services and products are right for them. Schwab’s goal is to make wealth management accessible to all and to accommodate clients’ unique financial situations and objectives.

A top priority for Schwab is the satisfaction and security of its clients. Schwab has been recognized for its outstanding service and client satisfaction, receiving the #1 rank in the J.D. Power 2023 U.S. Full-Service Investor Satisfaction Study. This accolade is a testament to Schwab’s dedication to putting clients first and providing a positive investing experience.

Schwab also takes the security of its clients seriously. The Schwab Security Guarantee ensures that clients’ accounts are protected, and the platform adheres to robust security measures to safeguard clients’ personal and financial information.

Opening an account with Schwab is straightforward and user-friendly. Clients can easily navigate through the process, and if they have any questions, Schwab is there to assist with top-notch customer service. The platform offers various communication channels, including phone support, online chat, and in-person visits to local branches.

For those interested in switching brokerage providers, Schwab streamlines the transition process to ensure a seamless experience. Clients can transfer their investments smoothly to Schwab, and the platform’s financial professionals are available to provide guidance and support throughout the process.

Another unique offering from Schwab is Schwab Bank, which provides banking and lending services. Clients can enjoy the convenience of having their banking and investment needs in one place, making it easier to manage their finances holistically.

In summary, Charles Schwab stands out as a comprehensive and client-centric wealth management platform. It’s transparent pricing, diverse investment options, high client satisfaction, and focus on security make it a trusted choice for investors seeking to secure their financial future.

Features

-

Transparent Pricing

Clear information on fees and costs, ensuring clients get value for their investments.

-

Wide Range of Accounts

Various account options, including brokerage, retirement, and small business plans.

-

Diverse Investment Products

Access to stocks, mutual funds, ETFs, annuities, and bonds for diversified portfolios.

-

Flexibility in Working with Schwab

Clients can choose services and products that align with their financial goals.

Reviews

0.0 out of 5 stars (based on 0 reviews)

Frequently Asked Questions

The Schwab Security Guarantee ensures that clients’ accounts are protected and reimbursed for unauthorized activity.

Schwab offers transparent pricing, and clients can see all fees associated with their investments upfront.

Opening an account with Schwab is easy and can be done online or by visiting a local branch for assistance.

Schwab provides a wide range of investment options, including stocks, mutual funds, ETFs, annuities, and bonds.

Schwab facilitates a smooth transition for clients looking to switch their investments to Schwab from other providers.

Please LoggIn To Write A Review

There are no reviews yet. Be the first one to write one.